On-chain analytic company Glassnode has damaged down which Bitcoin cohorts had been collecting and that have been dispensed all the way through the previous 12 months.

Bitcoin Whales Allotted Cash An identical To 60% Of Mined Provide In The Closing 12 Months

As consistent with information from Glassnode, whales, miners, and change outflows have been the main distribution assets up to now 12 months. The related indicator this is the “annually absorption charges,” which measures the once a year Bitcoin steadiness adjustments of the other cohorts available in the market and compares them with the collection of cash issued over this era.

The “cash issued” consult with the overall quantity BTC miners obtain as block rewards for mining a block. Those new cash produced have to head someplace, and that’s what the once a year absorption charges metric tries to color an image of the BTC provide glide.

The cohorts that Glassnode has thought to be are the shrimps (buyers protecting lower than 1 BTC), crabs (between 1 to 10 BTC), whales (greater than 1,000 BTC), and miners. Moreover, the company has additionally integrated information for the “exchange outflows,” which measure the overall collection of cash withdrawn from the wallets of all centralized exchanges.

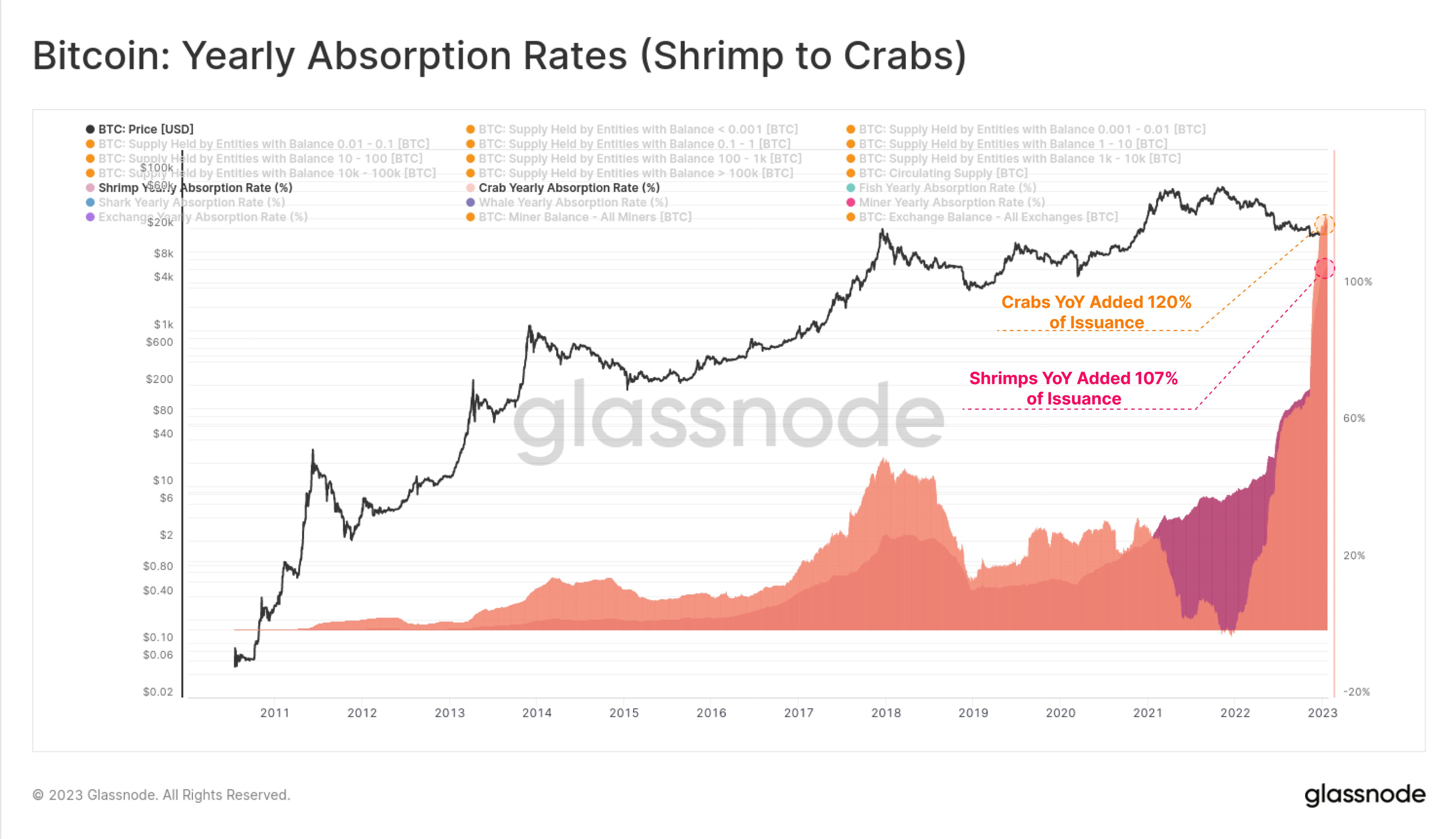

Now, first, underneath there’s a chart that presentations which of those investor teams have been soaking up a good quantity of the once a year coin issuance:

The worth of the metrics appear to have been moderately prime in contemporary weeks | Supply: Glassnode on Twitter

As proven within the above graph, the Bitcoin annually absorption price of the shrimps is 107% at the moment, which means that this investor workforce added 107% of the overall collection of cash issued at the community to their holdings all the way through the previous 12 months.

The indicator’s worth has been even upper for the crabs at round 120%. From the chart, it’s obvious that the metric has noticed an excessively fast upward push in the previous few months, suggesting that a large number of accumulation came about on the lows following the FTX cave in.

For the reason that quantities added by means of those cohorts are upper than what the community issued up to now 12 months, it kind of feels cheap to suppose that some teams should have dispensed or offered their cash to make up for the adaptation. The underneath chart presentations which cohorts displayed distribution conduct all the way through the previous 12 months.

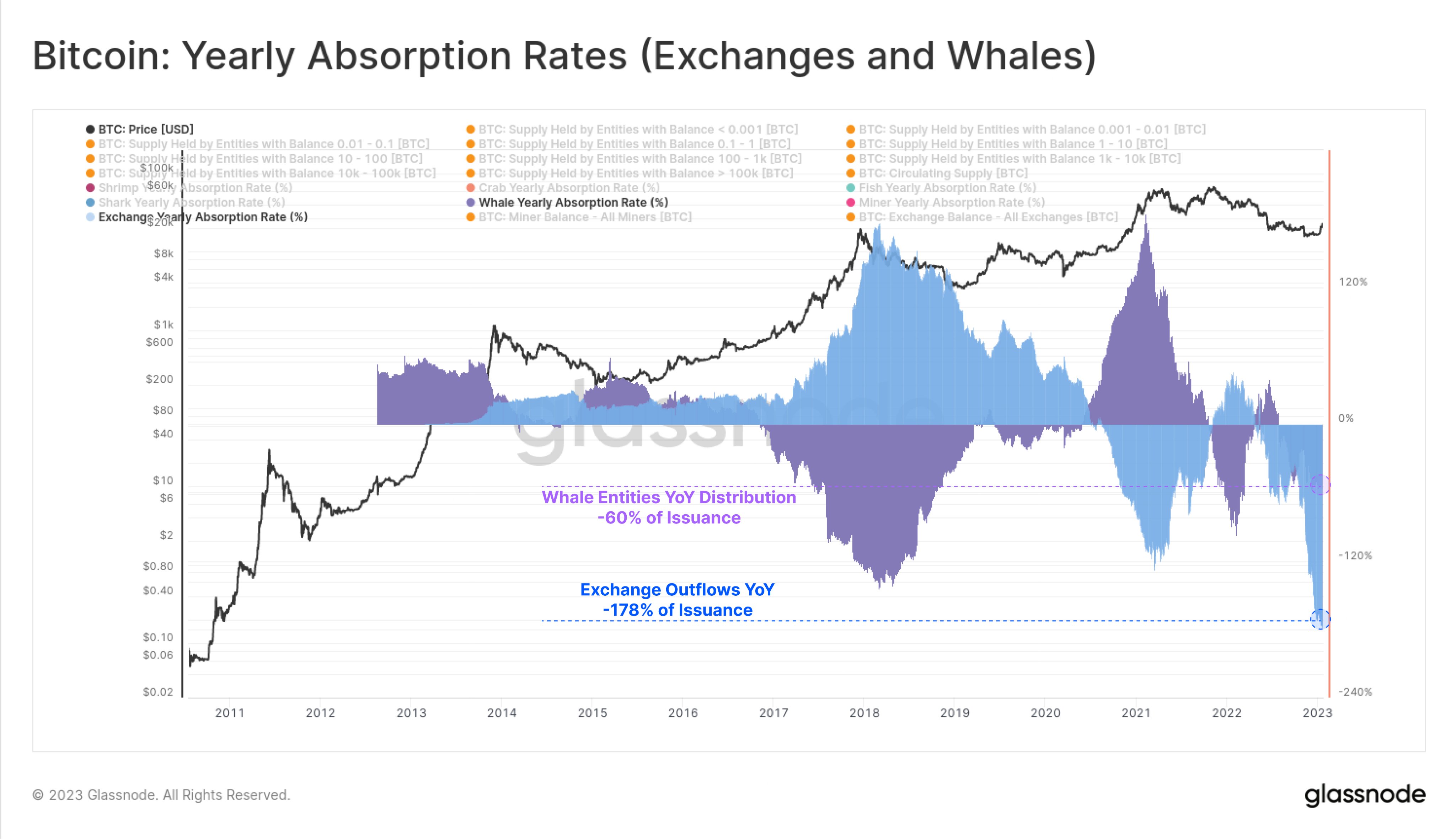

Seems like those metrics had been deeply damaging lately | Supply: Glassnode on Twitter

It sort of feels that the once a year absorption price of the whales is 60% underwater, which means that those humongous holders have shed cash equivalent to 60% of the issued provide from their wallets during the last 12 months.

Exchanges additionally dispensed an enormous quantity of Bitcoin because the metric’s worth was once damaging 178% for change outflows. Those platforms noticed huge withdrawals on this duration partially as a result of the FTX cave in, which made BTC holders extra acutely aware of the hazards of preserving their cash in centralized wallets. This led to an enormous migration of the BTC saved on centralized entities.

Customers switch huge quantities of BTC from exchanges to stay their holdings in privately owned {hardware} wallets. Although no longer displayed within the chart, Glassnode additionally mentions within the tweet that miners dispensed 100% of the cash they mined (which means that 100% of the issuance), plus an extra 2% from their current reserves.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $22,600, up 8% within the ultimate week.

BTC continues to transport sideways | Supply: BTCUSD on TradingView

Featured symbol from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)