Bitcoin and the crypto marketplace are again within the purple. The primary crypto by means of marketplace cap data a 2% loss within the closing 24-hours and may push different virtual property into vital enhance zones.

Similar Studying | Bitcoin Indicator Hits Historical Low Not Seen Since 2015

On the time of writing, Bitcoin is without doubt one of the best-performing property on this score best surpassed by means of Binance Coin (BNB) and Ethereum (ETH), in keeping with information from Coingecko. BTC’s worth trades at $37,600 with a 7% loss during the last week.

After a significant outage to its community, Solana (SOL) data a 16% loss and stands because the worst-performing cryptocurrency by means of marketplace cap. Terra’s local cryptocurrency LUNA intently follows with a 15.5%.

Those losses appear small when in comparison to different cryptocurrencies within the most sensible 100 by means of marketplace cap. Tokens that have been upper within the score, like Shiba Inu (SHIB) and Avalanche (AVAX), now file up to 20% losses in a single week on my own.

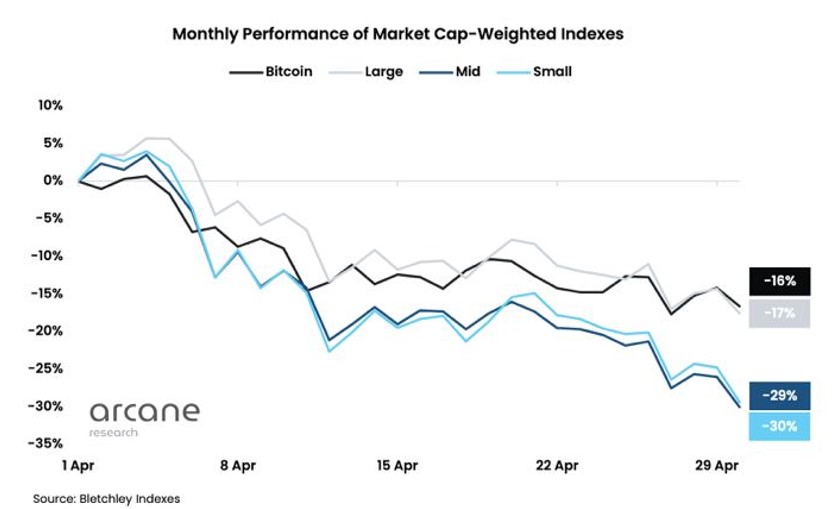

In line with a contemporary document from Arcane Analysis, smaller cryptocurrencies had been underperforming within the present marketplace circumstances. Buyers appear to be fleeting to “protection” because the urge for food for possibility decreases pending a possible 50 foundation level build up from the U.S. Federal Reserve (FED).

Whilst Bitcoin and bigger cryptocurrencies had been appearing a correlation with a 16% loss for April, Arcane Analysis’s small-cap index and mid-cap index are trending decrease. The previous file a 30% loss whilst the latter data a 29% loss over the similar length.

Conversely, Bitcoin’s dominance has been transferring reverse to small cash. This metric stands at 42% with a top likelihood of extending as macro-conditions proceed to turn out unfavourable. Arcane Analysis famous:

Stablecoins additionally see rising dominance. UST has entered the highest 10, changing into the primary algorithmic stablecoin to succeed in this. We have now 3 stablecoins a number of the most sensible 10, and four a number of the most sensible 11, illustrating the present flight to protection dispositions out there.

What To Be expecting From Bitcoin In The Brief Time period?

A separate document from FTX Get entry to claims the marketplace is pricing 50 bps hikes for the approaching 4 FED conferences. This is able to position rates of interest at round 2 or 2.Five bps for the top of 2022.

Similar Studying | Bitcoin Taker Buy-Sell Ratio Rebounds Back Into “Hold” Zone

In that sense, FTX Get entry to claims that until there’s a wonder from the monetary establishment, the marketplace may see some aid:

Powell’s tone will likely be attention-grabbing however with out elevating +75bps or expanding the tempo of QT it’s a top bar for a hawkish wonder. A few of that is reason for optimism, however sadly sentiment is all-time low.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)