This Might, the sector of crypto witnessed considered one of its greatest crashes ever. LUNA, the Terra local token, crashed to nearly 0. The crash was once of an enormous magnitude and controlled to wipe greater than $40 Billion of traders’ wealth in a question of days.

The crash resulted from the sick efficiency of the algorithmic solid coin, UST. It misplaced its peg to $1 and got here crashing right down to sooner or later land at lower than a cent value. Because of this, the Terra validators selected to halt the community, preventing the block manufacturing. In consequence, many exchanges delisted LUNA and UST to stop buyers from making losses by way of taking dangerous positions.

So, why precisely did LUNA crash? Apply alongside as we discover the LUNA crash intimately.

What’s Terra LUNA?

LUNA is the local token of the Terra blockchain. TerraUST is an algorithmic solid coin that works following LUNA to take care of its value of $1. The UST token is connected to the United States greenback, as maximum solid cash are connected to 1 fiat or the opposite.

Terra UST does no longer depend on a saved asset to derive its worth, however as an alternative generates it by way of following a algorithm. A specific amount of LUNA is burnt each time the cost of UST falls beneath $1 so the fee can get better. The other is finished when the fee crosses $1. Beneath this mechanism, the solid coin maintains its value.

Your capital is in peril.

What Came about to Terra LUNA

As discussed previous, for TerraUST to take care of its peg to $1, it will have to be minted or burnt. So if you want to purchase TerraUST, you’ll need to mint them by way of paying a going charge via LUNA. Those LUNA are then burnt, and in consequence, the cost of LUNA is going relatively up because of the availability contraction. This precise conversion way will also be carried out to the cash in opposite.

Convert UST -> Mint LUNA -> UST will get burnt -> Worth of UST is going up

Convert LUNA -> Mint UST -> LUNA will get burnt -> Worth of LUNA is going up

A large $285 million UST sell off initiated a domino impact of shorting the asset. Whilst the preliminary sell off was once lovely important, it was once complemented by way of more than one dumps of a substantial magnitude as the scoop took Twitter by way of hurricane. Because of this, the cost of each UST and LUNA began appearing a downward pattern.

To stabilize the UST peg, Terraform basis liquidated all of its 40ok Bitcoin holdings. Sidenote – Terraform basis was once some of the most sensible 10 holders of BTC. Because of this, the cost of Bitcoin witnessed a unexpected fall as smartly. By way of 12th Might, the fee reached a 10-month low of $26,350.49. This conduct was once parallel throughout most cryptocurrencies, and the crypto markets had been a number of purple candles.

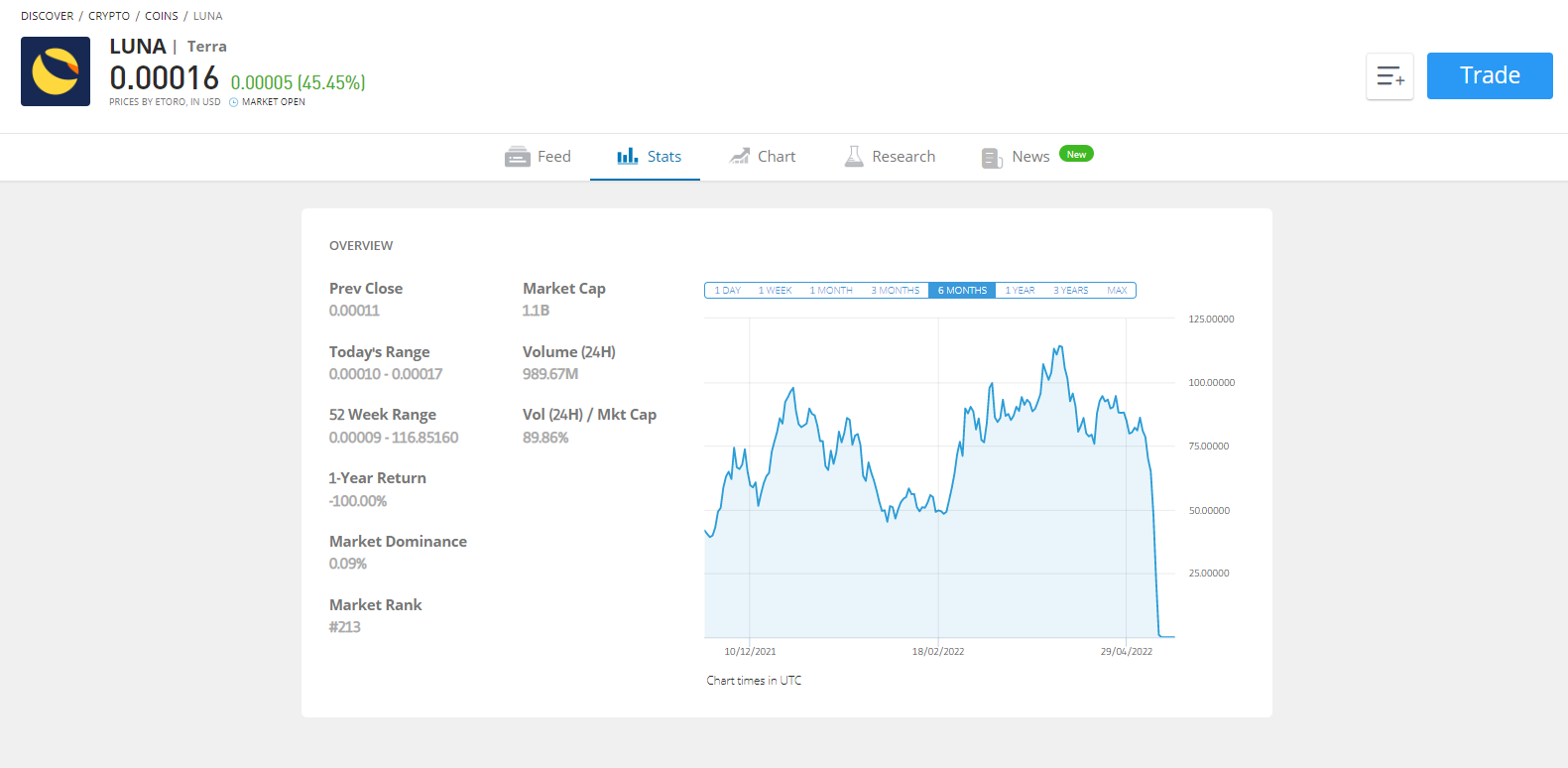

The full crypto marketplace bleeding supplemented the already plummeting value of LUNA, and it fell underneath a greenback after its ATH of $119 remaining month. Quickly after, the cost of LUNA fell by way of 99% more than one instances, sooner or later touchdown at an rock bottom of $0.00001675, nearly 0.

Remaining month, at its all-time top, the marketplace cap of LUNA stood at a whopping $40 Billion. Alternatively, it stands at an insignificant $979 million on the time of writing. The crash controlled to wipe nearly 40 billion greenbacks off traders’ wallet.

Hyperinflation of the Terra and LUNA provide was once the foremost reason for the autumn in costs. Earlier than the crash, there have been 350 million LUNA tokens in life, whilst after the crash, it rose to six.nine Trillion. The rise in provide is, to a undeniable extent, unexplainable.

eToro platform has once more indexed LUNA after transient delisting

Amidst this crypto disaster, many exchanges select to delist or halt the buying and selling of LUNA and UST. Binance and Crypto.com had been some of the few platforms to halt the buying and selling of LUNA. eToro too, selected to delist the token on the similar time. As of now, on the other hand, LUNA is to be had for industry on eToro.

Large shorting, failure of UST to take care of steadiness, marketplace sentiment, the halting of industry, and a couple of different minor causes had been all it took to make the LUNA crash occur. The token lately trades at $0.00015 and stays moderately risky.

It is probably not the most productive asset to industry at this time, assuming the chance concerned. However for those who nonetheless need to industry, you’ll do it on eToro. The platform fees 0 transaction charges and accepts more than one fee how you can make a fiat deposit. Make knowledgeable choices.

Learn extra:

Fortunate Block – Our Really helpful Crypto of 2022

- New Crypto Video games Platform

- Featured in Forbes, Nasdaq.com, Yahoo Finance

- International Competitions with Play to Earn Rewards

- LBLOCK Token Up 1000%+ From Presale

- Indexed on Pancakeswap, LBank

- Unfastened Tickets to Jackpot Prize Attracts for Holders

- Passive Source of revenue Rewards

- 10,000 NFTs Minted in 2022 – Now on NFTLaunchpad.com

- $1 Million NFT Jackpot in Might 2022

Cryptoassets are a extremely risky unregulated funding product. No UK or EU investor coverage.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)