Bitcoin continues to underperform as a common “risk-off” sentiment has traders riding towards gold as a secure haven asset.

Now not Risking It

Considerations concerning the Russo-Ukrainian battle proceed. The U.S. inflation struggles at a four-decade prime and Fed charge hike fears be successful. The uncertainty extends to the arena financial system as a recession is predicted as an alternative of a restoration. The IMF’s managing director Kristalina Georgieva referred to as it “a disaster on most sensible of a disaster.”

“The battle is a provide surprise that reduces financial output and raises costs. Certainly, we forecast inflation will boost up to five.five p.c in complex economies and to 9.three p.c in rising Ecu economies except for Russia, Turkey, and Ukraine. ” The IMF stated ultimate week.

Reuters not too long ago quoted Commerzbank analyst Daniel Briesemann, who talked in a be aware concerning the elements that experience “lent buoyancy to gold in contemporary days,” citing the “robust purchasing pastime at the a part of ETF (Alternate Traded Fund) traders” and information concerning the Ukraine battle.

“Russia seems to be getting ready to release a big offensive within the east of the rustic – this is producing really extensive call for for gold as a secure haven,” the analyst stated.

This summarizes the “risk-off” sentiment in this day and age. As anticipated, equities endure as traders are promoting dangerous belongings and buying those negatively correlated to the normal marketplace. Thus, the crypto area is suffering along de shares marketplace and gold is emerging.

Bitcoin Outperformed Via Gold

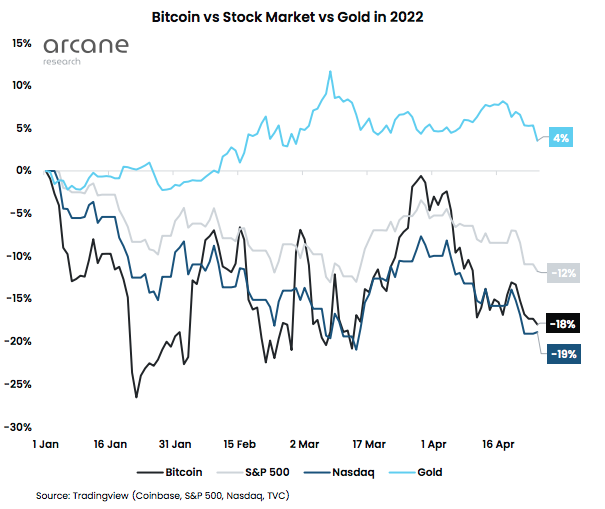

Information from Arcane Research’s latest weekly report notes that it’s been a dark 12 months for the “virtual gold.” Within the first 3 weeks of 2022, Bitcoin sank 25% and it’s nonetheless down by way of 18% within the 12 months regardless of its slight restoration.

In a similar fashion, Nasdaq data a 19% decline within the 12 months, having underperformed in opposition to bitcoin “by way of a small margin,” notes the file, including that “That is sudden for the reason that bitcoin has tended to practice Nasdaq, albeit with upper volatility.”

The overall concern over geopolitical and macroeconomic uncertainty has given gold the safe-haven asset highlight over again. The asset outperformed all of the different indexes observed underneath with a 4% achieve.

In the meantime, the foreign money marketplace is acting with “the similar risk-off patterns.” The Greenback has been proving its “risk-off” dominance as the United States Greenback Index (DXY) is up 7%. The Chinese language yuan has taken successful over issues concerning the nation’s “zero-covid” coverage –which creates problems for the worldwide provide chain– and the slowing down Chinese language financial system. Against this, traders were working to the United States Greenback for protection.

Bitcoin supporters generally seek advice from the coin as “virtual gold” alleging this is a secure haven asset, and this narrative had held smartly whilst BTC were “uncorrelated with maximum different primary asset categories,” however the tide is transferring with the 2022 state of affairs as traders are relatively putting the coin “into the risk-on basket”.

A prior Arcane Analysis file indicated that bitcoin’s 30 -day correlation with the Nasdaq is revisiting July 2020 highs whilst its correlation with gold has reached all-time lows.

A pseudonym traded noted that “As Bitcoin adoption is going on and extra institutional traders input the marketplace, the correlation of BTC and shares turns into increasingly more tight. That could be a paradigm that the crypto global struggled to come back to phrases with previously however is now extra actual than ever. A wholesome inventory marketplace is excellent for Bitcoin.”

In the meantime, the overall sentiment of investors appears to be bearish, with many announcing that the coin may talk over with the $30ok stage quickly.

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)