The Bitcoin value skilled a resurgence yesterday, reaching a excessive of $26,843, a 3.7% improve after its current crash from $29,000. The explanations behind this uptick are manifold.

Why Is Bitcoin Up?

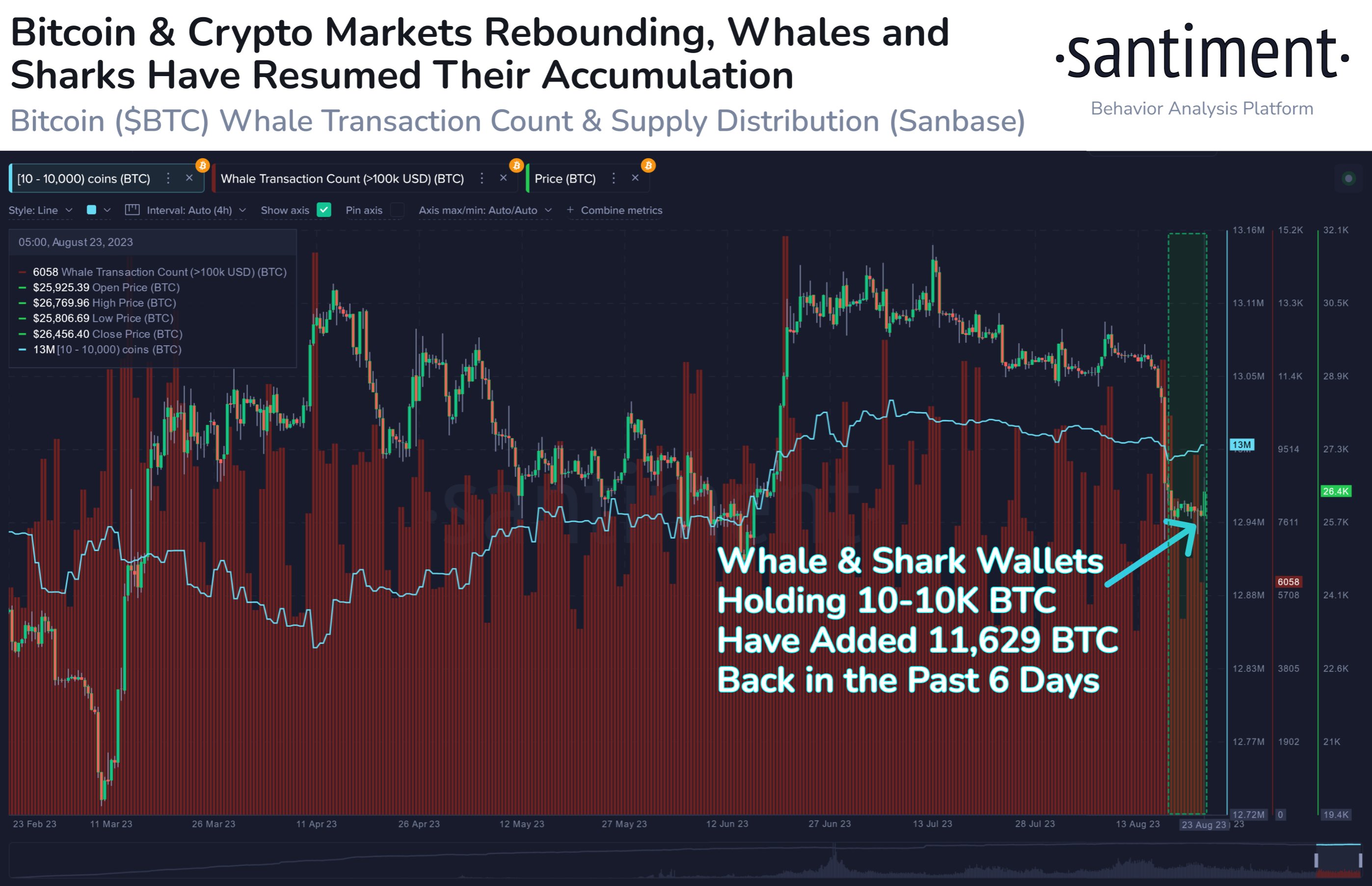

In response to on-chain analytics agency Santiment, vital Bitcoin holders, sometimes called whales and sharks, have been actively including to their holdings. As of now, there are 156,660 wallets holding between 10 to 10,000 BTC, with a collective accumulation of $308.6M since August seventeenth. Whale and shark wallets have added 11,629 BTC prior to now six days.

Michaël van de Poppe, a well-regarded crypto analyst, drew consideration to the power proven by Silver & Gold, particularly after the disappointing PMI charges yesterday. He believes that as yields look like topping out, Bitcoin may observe the trajectory of those commodities.

Latest financial indicators from the US non-public sector present additional context. The S&P World Composite PMI for early August confirmed a decline, falling to 50.4 from 52 in July. Each the Manufacturing and Providers PMI indices additionally registered drops from 49 to 47 and 52.4 to 51 respectively.

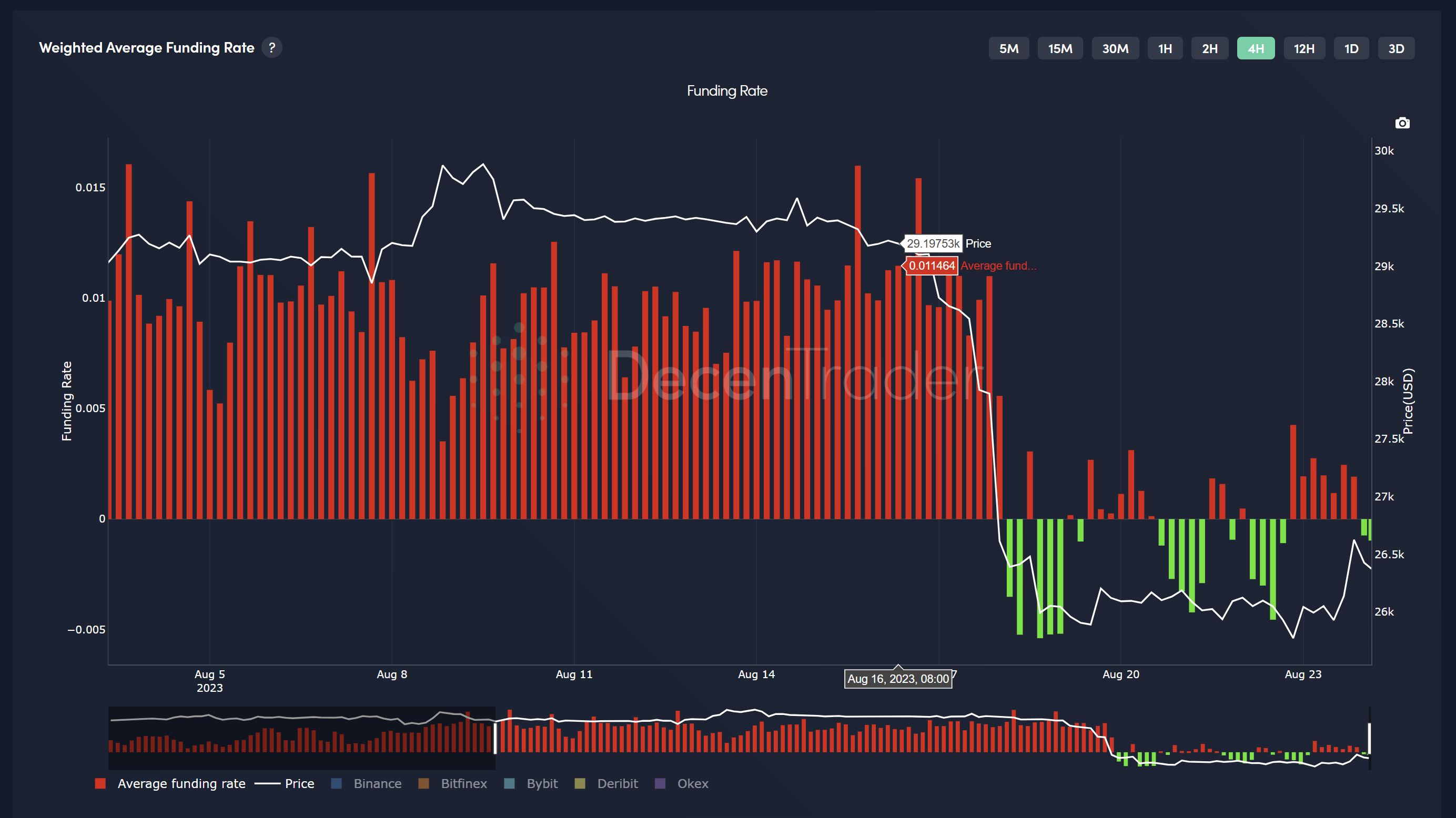

Furthermore, the Bitcoin futures market definitely performed a sure position in yesterday’s Bitcoin value motion. Yesterday, $28.06 million in brief positions had been liquidated on this market. In spite of everything, that is the third largest quantity in August up to now, surpassed solely by August 17 ($120 million) and August 8 ($37 million).

Market intelligence platform Decentrader highlighted the prevailing market sentiment, noting that regardless of Bitcoin’s value rise, there’s nonetheless a way of uncertainty and concern. This sentiment is additional underscored by the persevering with adverse dip in common funding charges. Whereas which means sentiment continues to be dangerous, it opens up the likelihood for extra brief squeezes if merchants are raging into shorts.

The Greenback-Index (DXY) and its inverse relationship with Bitcoin additionally performed an element. DXY was rejected just under 104 yesterday and dropped again to 103.5. The SPX confirmed a pleasant reduction bounce with USD coming off 103.96.

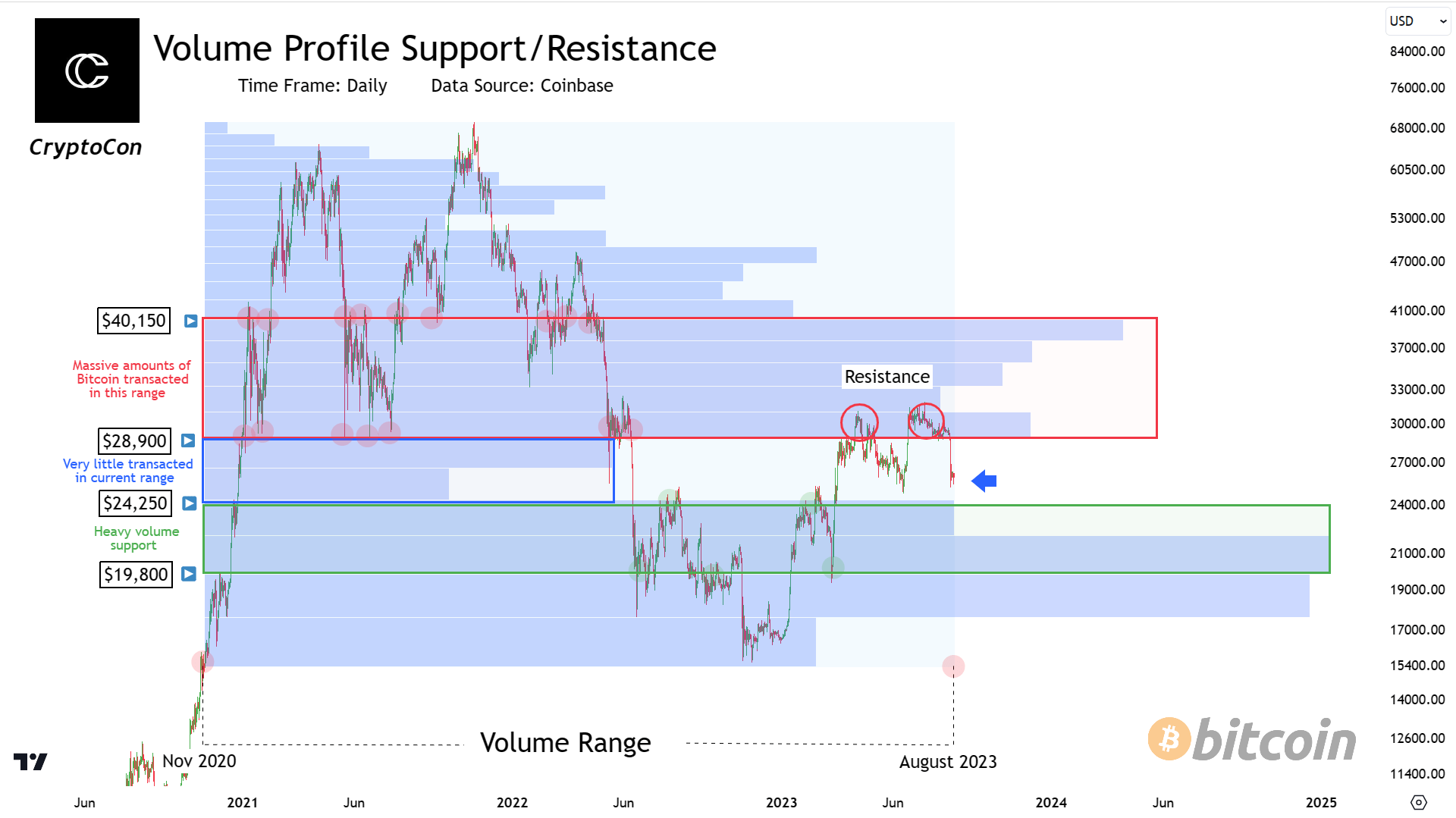

CryptoCon’s quantity evaluation affords a broader perspective on Bitcoin’s value motion. Since November 2020, the amount of Bitcoin transacted reveals why the value halted at its present place. The amount previous $28,900 acts as a big barrier. Nonetheless, the present vary of 24,000 to 29,000 for Bitcoin is comparatively uncharted, suggesting that Bitcoin is looking for new help and getting ready for a possible transfer to the subsequent resistance zone.

What’s Subsequent For BTC?

The upcoming Jackson Gap Financial Symposium tomorrow, Friday, the place the Federal Reserve will talk about its future methods, is a pivotal occasion on the horizon. Keith Alan of Materials Indicators recalled the affect of final yr’s symposium on Bitcoin, emphasizing, “Bear in mind when FED Chair Powell spoke from Jackson Gap final yr and his hawkish tone triggered a 29% BTC dump?”

Whereas there are parallels in Bitcoin’s value motion main as much as this yr’s occasion, it’s essential to notice that market reactions may be unpredictable and hinge on numerous components. With the Bitcoin market poised for the occasions of tomorrow, the prevailing temper is one in every of anticipation combined with warning.

At press time, BTC traded $26,464.

Featured picture from iStock, chart from TradingView.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)