Bitcoin is forming a sample that has traditionally led to the asset retesting a selected line. At current, this degree could be discovered at $20,500.

Bitcoin Has Dropped Under The 200-Day SMA With The Latest Crash

A number of days again, Bitcoin noticed a sharp crash that took the cryptocurrency’s value towards the $26,000 mark. As this plummet was already vital, many have questioned whether or not this was it or if the drawdown will proceed.

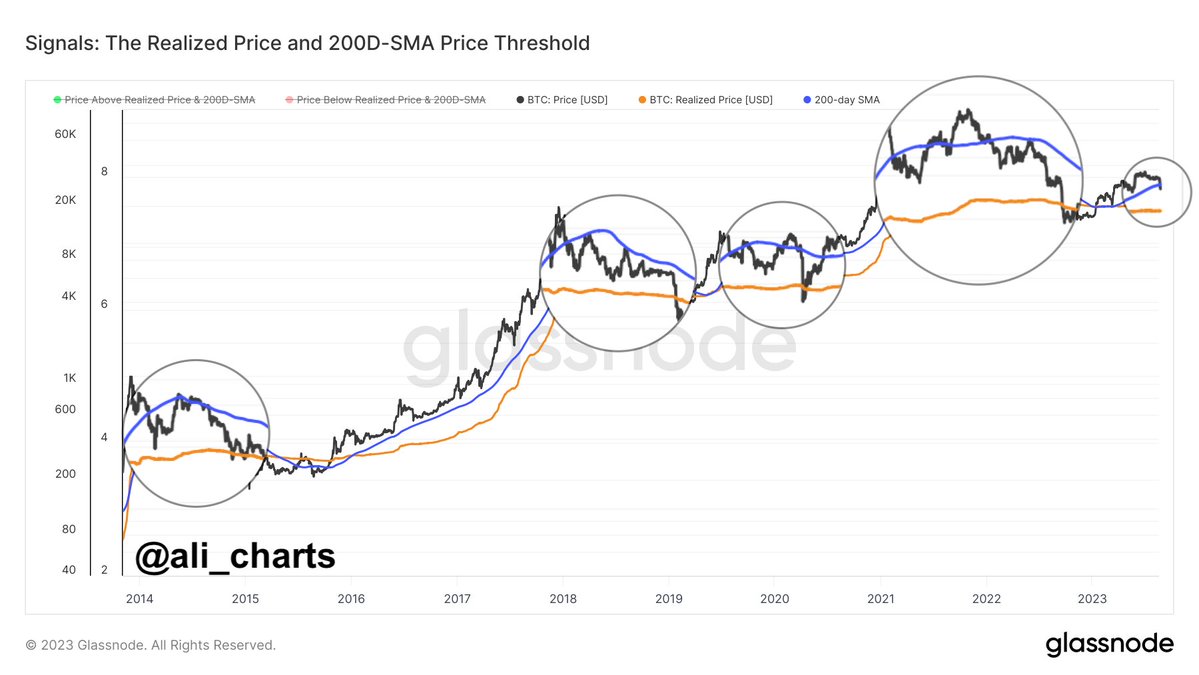

An analyst on X, Ali, shared a chart which will present hints about the place the asset could possibly be heading subsequent.

The development within the realized value and the 200-day SMA for BTC | Supply: @ali_charts on X

The analyst has connected the information for 2 Bitcoin-related metrics within the graph: the 200-day easy transferring common (SMA) and the realized value. The chart exhibits that the BTC value has dropped under the 200-day SMA (coloured in purple) with the most recent crash.

In accordance with the analyst, when the cryptocurrency’s value has crossed under this degree in the course of the previous ten years, it has usually retested the realized value (coloured in orange).

The “realized value” right here refers back to the price foundation or the shopping for value of the typical investor within the BTC market. Which means every time the cryptocurrency dips under this degree, the typical holder enters a state of loss. However, breaks above the road suggest a return to income for a lot of the market.

Traditionally, this metric has had some attention-grabbing interactions with the spot value of the coin. Throughout bullish durations, the road has usually supported the asset, whereas throughout bearish durations, it has acted as resistance.

The reason behind these curious interactions could lie in how the traders’ minds work in every interval. In bull markets, the typical investor might imagine that the value will solely go up, so every time the asset drops to its shopping for value, they accumulate extra of the asset.

Equally, in bearish tendencies, the holders could consider the cryptocurrency will solely go down, so the value they purchased in (their break-even mark) could be the best exit alternative.

This shopping for and promoting could trigger the extent to behave as assist and resistance within the respective regimes. The newest instance of this conduct was seen earlier within the yr when Bitcoin rebounded off the road again in March.

Because the asset now seems to have damaged under the 200-day SMA, it could be heading in the direction of a retest, as has usually occurred many instances up to now.

Proper now, the price foundation of the typical investor is $20,500, which signifies that if BTC goes to the touch this line once more, a major drawdown would wish to happen.

If this situation certainly performs out, then it’s doable that Bitcoin might discover a rebound on the realized value as soon as once more. A retest failure, nevertheless, could be a really regarding signal, as it’d sign the return of the bear market.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $26,000, down 11% within the final week.

BTC has been transferring sideways because the crash | Supply: BTCUSD on TradingView

Featured picture from Maxim Hopman on Unsplash.com, charts from TradingView.com, Glassnode.com

![Methods to Purchase DeFi Pulse Index on CoinStats [The Ultimate Guide 2022]](https://bitrrency.com/wp-content/uploads/2022/05/DeFi_Pulse_og-100x70.png)